Originally published on The Content Technologist on June 1, 2023, as “Keep brands weird: The research framework for exceptional data-driven content.”

Content strategy is a dance. It takes artful maneuvering to charm humans with poetry, appease algorithms with keywords, and win revenue with strategic budgeting. But you can't stun the audience if you're using the same moves as everyone else.

With algorithms homogenizing our feeds, it takes extra effort to look outside the usual places for inspiration. The good news: your competitors are as uninspiring as ever. The bad news: you run this risk as well if you’re feeding yourself the same inputs—using the same public AI platforms, drinking data from the same APIs, or reading the same newsletters and trend reports as everyone else.

These sources can provide utility, but creating content with an edge requires diversifying your inputs. Your brand won’t stand out unless you search deeper and farther than everyone else. Unless you build your own ethnographic toolbox and travel to unexplored internet highways and data troves, you're going to have a hard time making something new.

As Landor & Fitch Executive Director of Insights & Analytics, Americas Maarten Lagae advises, don’t rely on convenient data for strategic decisions:

"If you’re planning to manage a brand by simply looking at social media data, you might as well drive your car on the highway just using a flashlight…It requires more rigor, time and resources to find multi-faceted answers and develop solid business cases that unlock budgets, board approval and ultimately business growth."

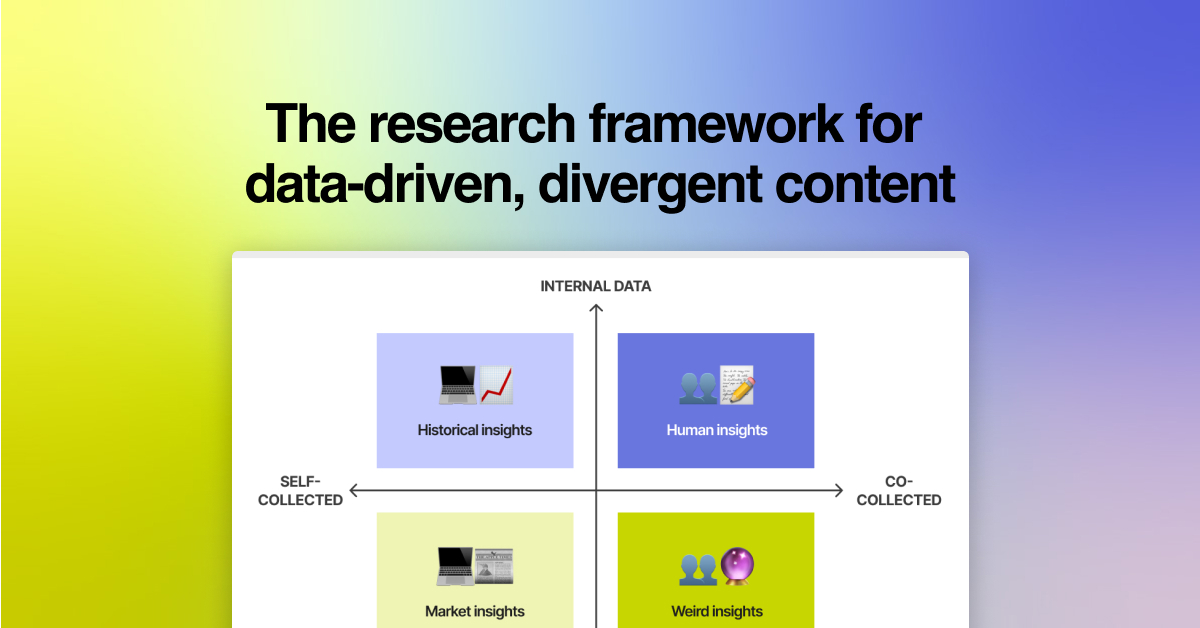

Not every content professional has a research team feeding into their work. If you need to seek out project insights yourself, this content research framework will help you find the right data—not just convenient data—for content strategy that makes a difference.

Today, you'll learn:

- How to diversify your inputs and do better work in an era of homogenization

- How to source the right data and maximize insight

- How to use the content research framework — with examples of using mixed methods across business use cases: brand positioning, performance reporting, tactical copywriting, campaign dreaming

Co-collected internal data reveals human context

What: Qualitative brand positioning and perception insights

How: Conducting internal employee interviews and surveys

When: During onboarding audits and key company moments like a rebrand, strategy pivot, or new product launch

Why: To understand the human dynamics behind brand perception.

Questions to answer: How does external brand positioning match internal perception? Where are the gaps and opportunities to bridge this? What are the underlying organizational norms or cultural biases behind company language?

Whether you've just joined a company or started consulting for one, consider who might be able to offer brand perception insights, outside of your main stakeholders or collaborators.

Employee interviews are an effective way to glean brand insights, but they're also time-intensive. You might not be able to get a 30-minute interview with senior stakeholders across teams, or you might not think to spend time with more junior team members.

Complementary mini-surveys can scale insights and surface trends faster than conducting individual or group interviews. You could also run a survey first, and then use trends from the findings to inform the questions you ask in deep dive interviews.

Try asking employees to describe the company's value proposition in one or two sentences. Pretend they're introducing the organization to a prospect at a conference, without looking at the website for reference.

Collect the survey responses in a spreadsheet and note keyword trends. See where it deviates from the language you're hearing from executives. Make a checkbox to mark how many employees mirror executive phrasing, and see what percentage it is. Don't be surprised if it's just 1/4 of the company. That gives you a sense of how far the vision has trickled down, and where the reconciling work is to be done.

For sample size, be strategic. You don't need a huge sample if you're talking to key stakeholders who have influence on decisions and team training. And if you'll be manually analyzing open-ended responses, 15–20 respondents is a good cap to protect your own time while still getting an accurate look at the brand.

Self-collected internal data reveals historical context

What: Quantitative brand and content performance insights

How: Pulling metrics from tools across the organizational tech stack

When: Onboarding audit, and key reporting moments that inform future strategy (e.g. an end of year review)

Why: See where past actions went right or wrong, so you can double down on the right and avoid the wrong.

Questions to answer: What strikes you about the data? What validates your intuition or surfaces new insight? How might these findings back your next decisions with confidence?

There's no way around deep data analysis. If you're in-house, dig around. If you're a consultant, ask for metrics reports across platforms. Even if you might not use them, it's better to have more than less. Look everywhere:

- website traffic and engagement reports (GA4)

- revenue and leads (Salesforce, sales enablement platforms)

- email and campaigns (ESPs like Hubspot, Mailchimp)

- editorial and creative operations (project management tools like Airtable, Notion, Asana)

- social media (platforms like LinkedIn, Twitter, YouTube)

- product analytics (tools like Amplitude, Mixpanel)

- brand tracking and media monitoring (tools like Meltwater, Morning Consult)

- your notes (anecdotal stories and screenshots collected over time or requested from your clients and client-facing teams)

Download all the reports, close Slack, and get dirty with the data. For example, your conclusions and recommendations might look like:

- It's worth investing in deep subject matter expertise, even in this economy, because last year those packages contributed to up to 30% increase in QOQ revenue.

- Let's continue to publish quality over quantity, because last year web engagement increased during the quarter that publishing volume decreased.

- Let's refine our process to identify marketing-ready client partners with sales, since 7 out of 10 of our top performing content pieces were partnerships with strategic accounts.

A tip on how to extract insights from the data, from one of my ex-consulting VPs: "I sit, and I think really hard."

Self-collected external data reveals market context

What: Qualitative market and persona insights

How: Doing desk research, reading industry publications, following thought leaders

When: Always on!

Why: Understand the language of your target audience.

Questions to answer: What's familiar or foreign to them? Where are the nuances in how they operate? How might you quickly internalize their world and reflect it in the content you publish?

Writing case studies and articles? Website landing page copy? Marketing and sales emails? Check out:

- Industry reports: Scan McKinsey, Gartner, Forrester (etc.) whitepapers for industry trends and challenges

- LinkedIn bios and websites of key clients and prospects: Pull Salesforce data or ask for lists of target customers, along with job titles. See what language they use to describe their successes and passions.

- Press around key clients and prospects: See the potential newsworthy impact your company can enable, so you can channel that charisma and speak to your clients' future successes with concrete examples

If anyone has success stories of using generative AI to expedite this research process, I'd love to hear them.

Co-collected external data inspires weird ideas

What: Hybrid quant/qual cultural insights

How: Engaging with communities, inside and outside your industry

When: Always on!

Why: Enrich your inputs with the unexpected. This quadrant yields award-winning content and puts you on the map of those you aspire to be like.

Questions to answer: What's the content that no one's searching for — yet? What's the stuff that's hard to scale? What can you learn from communities that see the world in a different light?

My favorite quadrant is the wild child. Go to industry conferences and meetups, speak up in Discords and Slacks, join your local club for your weird hobby. (Or if you're like me, sit at the bar and write poetry.)

At NewtonX, our Head of Brand & Marketing Jackie Cutrone had the idea to do a New York Mag-inspired culture matrix, but for B2B research instead of consumer trends. We brought this to life through the 2023 Insights Matrix, a fun selling tool that showcased our client partnerships and industry expertise.

For Currant, my food media collective, our editor Sarah Cooke proposed the concept of Climate, Changed: a series on climate change through the lens of jam producers. It became a year-long project that took us in original reporting across six producers across the US.

Creating newness requires a long game approach to ROI. These explorations shouldn’t be measured the same way as top-of-funnel lead generation efforts or bottom-of-funnel conversion tactics. Beyond getting eyeballs to your website or pushing them to purchase, wild card initiatives get users to stay, luxuriate, and wander around. They enable your audience to enjoy your brand, and yield customer loyalty and retention.

It also requires the right timing. First, build stakeholder trust and organizational credibility so you're insured through uncertainty. Then, ship the weird and watch the waves roll in.

Use the content research framework to channel multifaceted curiosity into content success

There you have it: the map of the content ethnographer's research toolkit, applicable whether you're working in-house for a brand or independently consulting for one.

Remember: you won’t see the whole picture by examining each quadrant alone. Internal data will show you where you're at, but not necessarily where you're aiming to be. External data won't be customized for your business. Individually collected data is limiting; collectively sourced data isn’t scalable.

For the framework to work, you need to be pulling from every quadrant — applying mixed methods to your research and multifaceted curiosity to its synthesis. You'll find the gems of insight by putting in the effort to excavate them and polishing them until they shine.

Interested in more creative strategy insights? Subscribe to my newsletter hyperdisciplinary and The Content Technologist.

Thanks to Arikia Millikan and Deborah Carver for the edits.