Latest in: brand

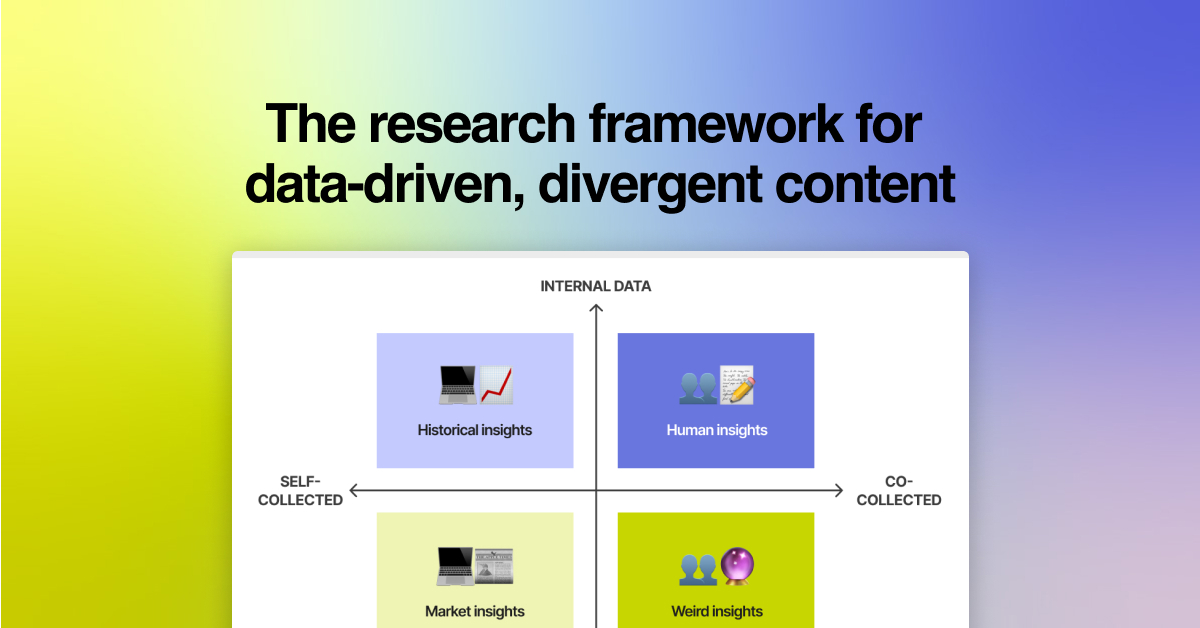

Originally published on The Content Technologist on June 1, 2023, as “Keep brands weird: The research framework for exceptional data-driven content.” Content strategy is a dance. It takes artful maneuvering to charm humans with …

Originally published on The Content Technologist on March 16, 2023, as “Why content strategists should add visual concepting software to their toolkits.” ChatGPT and its generative friends may look shiny, but don't forget about …

© 2025 Vicky Gu